Struggling with small business accounting and tax compliance? Learn how cloud accounting, automation, and outsourced accounting services help small businesses streamline operations, cut costs, and stay compliant in 2025.

Expert insights from True Ledger Consulting

Small Business Accounting Challenges: Why Do Traditional Methods Fail?

Running a small business is exciting—until you hit the accounting, tax, and payroll roadblocks. For many business owners, managing finances isn’t just about tracking numbers; it’s about juggling tax deadlines, payroll compliance, cash flow, and accurate reporting.

Unfortunately, most small businesses lack the infrastructure to manage these efficiently, leading to cash flow crunches, IRS penalties, and wasted time. The good news? Cloud accounting, automation tools, and outsourced accounting services can turn these challenges into growth opportunities. Let’s dive into the real problems small businesses face—and how technology + expert support can solve them.

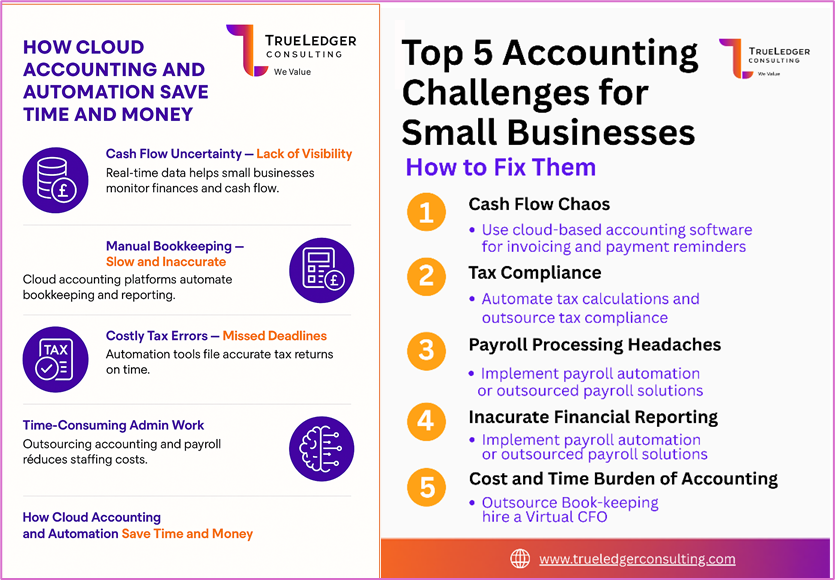

Common Small Business Accounting Challenges (And Smart Solutions)

1. Cash Flow Chaos and Unpaid Invoices

Late invoicing and poor receivables management sabotage small business cash flow.

Cash flow is the #1 reason small businesses fail. Why? Because:

- Invoices aren’t sent on time.

- Payments are delayed by clients.

- Businesses struggle to track receivables and payables.

📉 Impact: Without a proper system, business owners don’t know how much money is coming in or going out, leading to last-minute financial surprises.

💡Solution:

Cloud-based accounting software like QuickBooks Online, Xero, and Zoho Books streamline invoicing, automate reminders, and integrate with payment processors like Stripe and PayPal.

2. Tax Compliance Nightmares

Missed deductions, late filings, and multi-state tax chaos are major pitfalls.

Missing a tax deadline? That’s a costly mistake.

Businesses often struggle with:

- Tracking deductible expenses → Missing tax-saving opportunities.

- Late tax filings → Leading to IRS penalties.

- Multi-state or international sales tax → E-commerce businesses, in particular, struggle with sales tax nexus.

📉 Impact: unexpected tax bills, compliance risks, and avoidable penalties.

💡Solution:

- Tax automation tools (like TaxJar, Avalara) handle sales tax calculations.

- Cloud-based accounting software integrates tax calculations automatically.

- Outsourced tax compliance teams ensure filings are always accurate and on time.

Example: An e-commerce startup selling in the US and UK faced constant VAT and sales tax compliance issues. By using TaxJar for automation and outsourcing tax compliance, they eliminated tax errors and focused on growth.

3. Payroll Processing Headaches

Payroll isn’t just about paying salaries—it involves tax calculations, deductions, and compliance with employment laws.

Common payroll issues include:

- Misclassified employees vs. contractors → IRS penalties.

- Errors in tax withholdings → Leading to employee dissatisfaction.

- Missed deadlines for payroll tax submissions → Resulting in fines.

📉 Impact: Payroll errors can lead to costly legal troubles, unhappy employees, and compliance risks.

💡 Solution:

- Payroll automation software like Gusto, ADP, or QuickBooks Payroll calculates wages, taxes, and benefits automatically.

- Outsourced payroll processing teams handle tax filings, timesheet reconciliations, and compliance.

Example: A tech startup with remote employees in multiple states was struggling with payroll tax compliance. By switching to ADP Payroll + outsourcing compliance management, they eliminated payroll errors and reduced HR workload by 70%.

4. Inaccurate Financial Reporting

Many small businesses make decisions based on gut feeling rather than real data. That’s because:

- Financial reports are delayed or inaccurate.

- Owners don’t have a clear view of profitability.

- Tracking KPIs (like revenue per client, profit margins) is difficult.

📉 Impact: Poor decision-making leads to unnecessary expenses, pricing issues, and financial instability.

💡 Solution:

- Cloud accounting platforms provide real-time dashboards.

- Automated financial reporting tools (like Fathom, Syft Analytics) offer insights into business health.

- Outsourced accounting teams prepare custom reports, financial forecasts, and strategy insights.

Example: A small manufacturing business switched to cloud-based accounting with real-time reporting. They identified cost inefficiencies, renegotiated vendor contracts, and improved profit margins by 20%.

5. High Costs and Time Wasted on Accounting

Hiring a full-time accountant or CFO is expensive, especially for small businesses.

- US-based in-house accountant: $60,000 – $80,000 per year

- Part-time bookkeeper: $2,000+ per month

- Time spent on DIY accounting: 10+ hours per week (lost productivity!)

📉 Impact: Business owners either overspend on accounting staff or waste valuable time on bookkeeping instead of growing their business.

💡 Solution:

Outsourcing = Expert Accounting Without the High Costs

- Bookkeeping outsourcing → Monthly reconciliations & reporting handled externally.

- Virtual CFO services → Strategic financial guidance without hiring a full-time CFO.

- Tax filing & compliance outsourcing → No more tax season stress.

Example: A small consulting firm outsourced their accounting & tax filing. They saved 50% in accounting costs and spent more time on business development

How Cloud Accounting + Outsourcing Is a Game-Changer

Imagine your business running:

- Xero or QuickBooks Online for live financials

- TaxJar automation tools (like Avalara) for seamless sales tax compliance

- ADP for error-free payroll

- Outsourced accountants managing reconciliations, filings, and reporting

Results?

- Financial reports are always up to date.

- Tax compliance is automated & error-free.

- Payroll is processed on time, without HR stress.

- Business decisions are data-driven, not guesswork.

Final Thoughts: Why Small Businesses Need Smarter Accounting Solutions?

- The days of manual spreadsheets, tax season panic, and missed payroll runs are over.

- With cloud accounting, automation, and outsourced tax and accounting services, small businesses can:

- Reduce accounting and payroll costs by up to 50%

- Drive smarter, data-backed growth decisions

- Focus on business growth—not admin work

- Get financial insights in real-time

- Eliminate tax compliance risks

Is your business ready to move beyond traditional accounting?

Looking for Smarter Accounting Support?

At True Ledger Consulting, we specialize in outsourced accounting, cloud bookkeeping, payroll management, and tax compliance services tailored for small businesses across the U.S., U.K., and globally.

Contact our team today for a free consultation.

Visit: www.trueledgerconsulting.com