The Tax Season Crunch: Why CPA Outsourcing to India Is the Smarter Solution

CPA outsourcing to India has become the go-to strategy for firms looking to survive and thrive during tax season. Every CPA and accounting firm feels the pressure once January hits — tax season kicks in, inboxes overflow, filings pile up, and deadlines loom large. It’s a familiar cycle of stress and burnout.

Over the years, firms have tried everything — hiring temporary staff, relying on automation, or even turning away smaller clients. But these are short-term fixes that don’t solve the core issue: capacity and efficiency.

That’s where CPA outsourcing to India changes the game. More than just a cost-saving tactic, it’s a scalable growth strategy that delivers consistent support, speed, and accuracy — not just during tax season, but all year long.

In this post, we’ll explore why India has emerged as the top offshore destination for CPAs and how it’s reshaping the way firms navigate peak tax periods and long-term expansion.

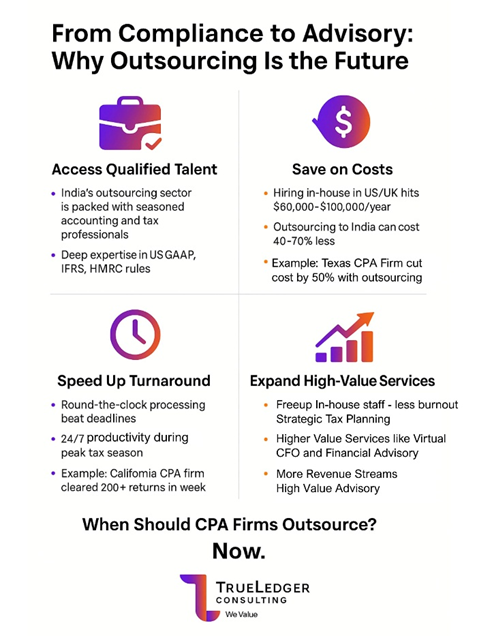

Why CPA Outsourcing to India Offers More Than Just Cost Savings

1. Access to Highly Skilled Accounting Professionals & Global-Ready Talent

If you’re picturing outsourcing as handing off work to low-cost, unqualified staff—think again. India’s outsourcing sector is packed with seasoned accounting and tax professionals who specialize in US GAAP, IFRS, IRS compliance, UK FRS, and Australian taxation.

- India has over 300,000 Chartered Accountants (CAs) and thousands of US/UK CPA-qualified professionals.

- Leading Indian universities and training institutes produce top-tier accountants, many of whom are well-versed in international tax laws.

- Deep expertise in US GAAP, IFRS, HMRC compliance, and Australian tax law

- Several outsourcing providers have Big 4-trained professionals leading their teams, ensuring expertise at par with Western firms.

Result: Instant access to qualified talent pool without the hassle of recruitment delays or training costs.

💡 Did you know? India produces more finance and accounting graduates annually than any other country, making it a global leader in the financial services outsourcing market.

2. Cost Efficiency Without Compromising Quality

- Hiring a full-time accountant in the US or UK can cost anywhere from $60,000 to $100,000 per year (plus benefits).

- In India, you can get the same expertise for 40-70% less, allowing firms to scale operations efficiently without breaking the bank.

But cost isn’t the only factor— Outsourcing to India can deliver the same expertise at 40–70% lower cost, with access to specialists in:

- QuickBooks Online, Xero, Sage, NetSuite

- IRS, HMRC, and ATO regulatory frameworks

🔹 Case Study: A mid-sized CPA firm in Texas recently outsourced its bookkeeping, tax prep, and payroll processing to an India-based firm. Result? They cut costs by 50% and freed up senior accountants for high-value advisory work.

3. The 24/7 Work Cycle: Beat Deadlines Without the Burnout

Imagine this: You wrap up your day at 6 PM, hand over tax returns to your offshore team in India, and by the time you wake up, the work is already done.

That’s the magic of India’s time zone advantage.

India’s time zone = your overnight delivery advantage.

- Work handed off in the evening is ready by morning: While CPA firms in the US, UK, or Australia end their workday, Indian teams are just starting theirs.

- Enables round-the-clock productivity during tax season: This creates a 24-hour work cycle, allowing firms to complete filings twice as fast while reducing last-minute tax season stress.

- Eliminates last-minute stress while increasing turnaround speed: For tax-heavy firms, this means faster client service, reduced backlogs, and a seamless workflow.

💡 Pro tip: Many CPA firms now use Indian offshore teams not only for tax prep, but also for bookkeeping, payroll, and year-round compliance.

How Outsourcing to India Transforms Tax Season for CPA Firms

During peak tax season, CPAs don’t just need junior temps—they need experienced professionals who can step in and deliver capacity, accuracy, and speed.

Here’s how outsourcing to India helps firms stay ahead of the tax rush:

1. Scale Without Hiring More Staff

Avoid seasonal recruitment and overhead costs. Offshore teams are trained, experienced, and ready to deliver. Recruiting temporary staff for tax season is costly, time-consuming, and inefficient.

Outcome: More work done, fewer HR headaches, and no unnecessary overhead costs.

2. Meet Tight Deadlines with Overnight Processing

Tax returns prepared offshore overnight free up your team for review, advisory, and client communication. With India’s time zone advantage, tax filings that would take weeks to process in-house can be completed in half the time.

- Offshore teams handle data entry, return preparation, and reconciliation while in-house staff focus on client advisory & review work.

- Result? More clients served, higher revenue, and less tax season chaos.

🔹 Example: A California based CPA firm cleared 200+ tax returns in one week with an Indian offshore partner, reducing last-minute filing stress.

3. Expand Services Beyond Tax Prep

With offshore teams managing compliance-heavy work, CPA firms freeing their in-house staff can offer higher-value services such as:

Free your in-house staff from compliance so they can focus on:

- Strategic tax planning: Strategic Tax planning for businesses & HNIs (high-net-worth individuals)

- IRS audit defense: IRS audit support & compliance consulting

- Virtual CFO services & Financial Advisory

Result: More revenue streams from high-value long-term advisory, less staff burnout.

Beyond Tax Season: Offshore Teams as Long-Term Strategic Partners

Outsourcing isn’t just for busy tax prep season — it’s a year-round growth strategy.

With the right partner, CPA firms gain:

- Updated Monthly bookkeeping & reconciliations

- Payroll processing & compliance checks

- Manage Sales tax & global VAT returns

- Financial Reporting dashboards & KPIs

- Data analytics and real-time reporting

🔹 The Big Picture: Lower costs. Higher capacity. Better service. Amplified Revenues all year long, without overloading staff.

🧠 Final Thoughts:

It’s Not “Should We Outsource?” — It’s “How Soon?”

CPA firms that adapt now will be better equipped to:

- Operate efficiently in an automation + outsourcing world

- Handle complex tax seasons without chaos

- Scale Services without increasing costs

- Deliver premium advisory at scale

- Stay competitive in the industry

So, the question isn’t “Should we outsource?”

It’s “How fast can we start?”

Looking to streamline your tax season workload?

🚀 At True Ledger Consulting, we help CPA firms in the US, UK, and Australia scale operations, optimize margins, and deliver client-ready outputs — all through reliable, high-quality offshore accounting solutions.

📞 Ready to Transform How You Handle Tax Season?

We offer specialized outsourcing for:

- Tax preparation

- Payroll processing

- Bookkeeping & reconciliations

- Sales tax/VAT compliance

- Virtual CFO support

📩 Schedule a free consultation today and let our India-based accounting teams take the pressure off your practice.

🌐 Visit: www.trueledgerconsulting.com

📧 Email: connect@trueledgerconsulting.com